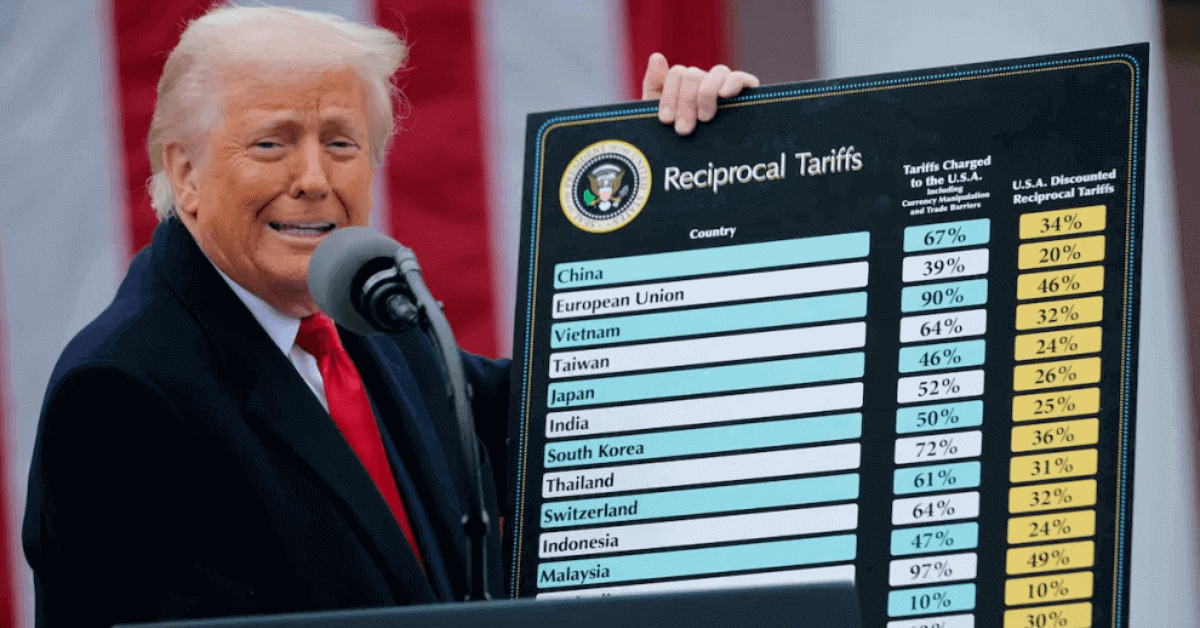

A 26% reciprocal tariff imposed by the Trump administration on Indian imports started to affect Indian exporters and renewable energy sector exporters particularly since April 9, 2025. Waaree Energies Ltd. experiences major effects from the newly applied United States tariff policy because the company maintains major solar module export businesses with America.

Impact on Waaree Energies

Waaree Energies derives a quarter of its business income from the United States market. The company maintained a 50,000 crore (26.5 GW) total order book in January 2025 where foreign markets consisted of 54% including the United States. Waaree’s new pricing strategy together with profit margin structures are directly influenced by the recently established trade tariffs.

Strategic Responses

Waaree Energies has taken several strategic actions to reduce the negative effects of these tariffs on its business operations.

Using its 1.6 GW manufacturing capacity, Waaree began commercial operations at its Brookshire, Texas, facility in January 2025. Over the next four years Waaree Energies intends to spend $1 billion as a way to raise its manufacturing capacity to 5 GW by 2027 thus decreasing import dependence while avoiding tariff restrictions.

The company operates a strategy to expand its export markets in the Middle East and African territories as well as the Australian market to reduce U.S.-market dependence.

Reuters

The company works actively to grow its domestic production facilities during this period. Waaree established the largest 5.4 GW solar cell manufacturing facility in Chikhli Gujarat during March 2025.

Supply Chain Considerations

The company imports 90% of its raw materials for solar cells using suppliers in China, Vietnam, Malaysia, and Thailand whereas Chinese suppliers contribute to half of the materials. The company suffers vulnerability because it heavily depends on international components which makes it susceptible to both trading policy changes and supply network interferences.

Financial Performance

The company delivered vigorous Q3 FY25 financial results even though it confronted significant obstacles.

- Revenue from Operations: Surged 116.6% year-over-year to 3,457.3 crore.

- The company achieved a 296% increase in net profit which reached 492.69 crore during Q3 FY25.

The company experienced significant performance growth as EBITDA for Q3 FY25 rose by 321.5% to 721.71 crore while the operating profit margin expanded to 20.9%.

Business & Finance News

Industry Outlook

The renewable energy industry worldwide will expand by 12% annually from 2024 to 2030 while its capacity increases from 4.9 TW to 9.8 TW. The renewable energy capacity in India will expand with a higher compound annual growth rate reaching 500 GW from 209 GW. The environmental sector expects solar energy to dominate since global solar capacity will grow to 5.8 TW by 2030 and India aims to develop 280 GW of solar power.

Waaree Solar Panels

Conclusion

Waaree Energies faces major difficulties because of the 26% duty that the United States has imposed. Waaree plans to handle current market challenges by opening new production facilities in the United States while expanding business operations abroad and building stronger domestic solar power capacities. The company maintains strong financial performance gained through proactive initiatives that allow it to stay as a key player within the worldwide renewable energy market.